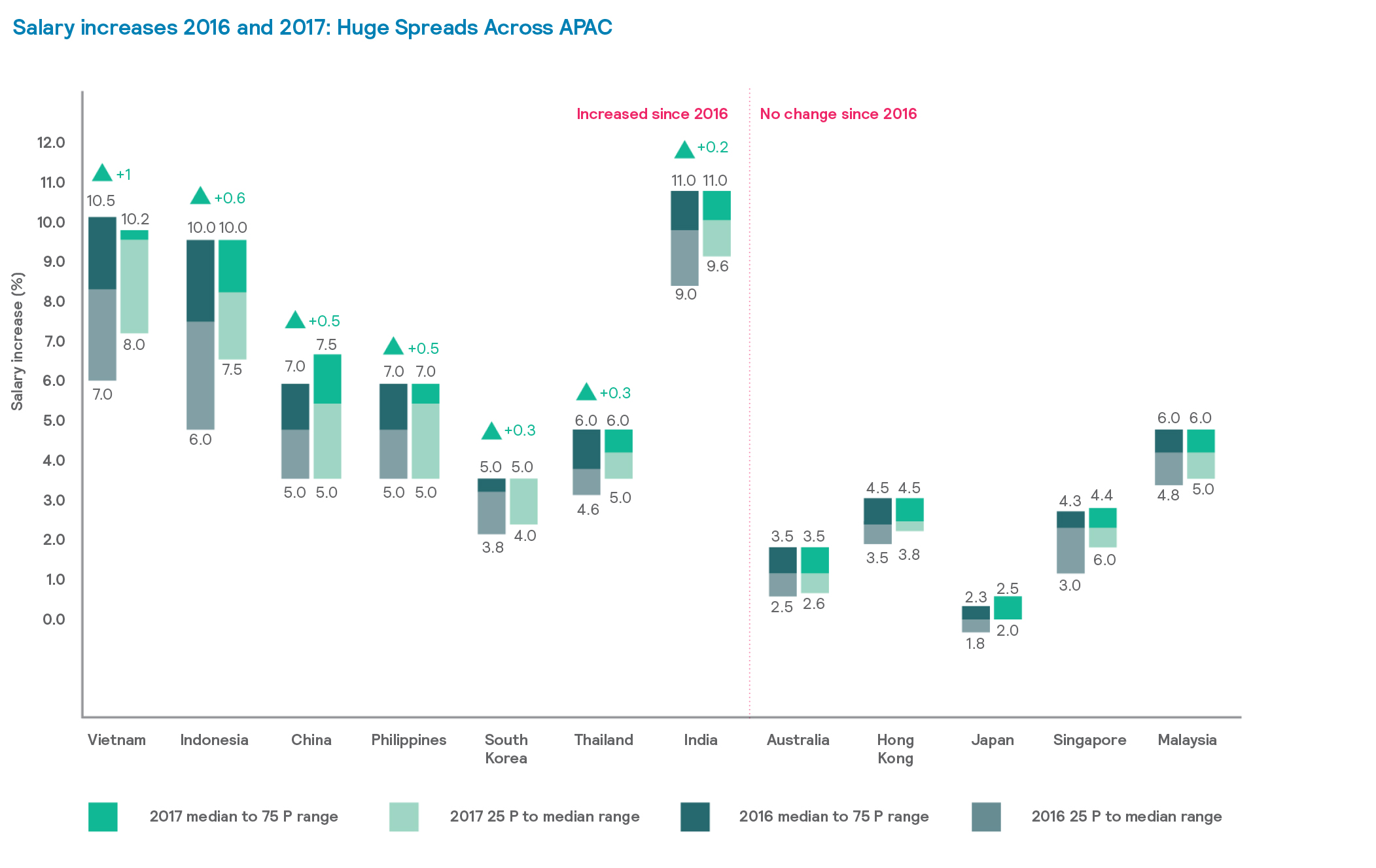

“The huge spread in base-pay increases across Asia Pacific is a clear reflection of the dichotomy of emerging versus matured economies."

After five years of weak growth, the global economy has thankfully entered a period of sustained, albeit mild, recovery. Job and capital markets around the world are seeing a positive outlook with the increase in global trade volumes, protectionist fears notwithstanding. The Asia Pacific region has been at the forefront of this recovery with the lowest unemployment and highest GDP growth rates in the world. This growth has been largely driven by improvements in the commodities and manufacturing sectors, along with the positive sentiment around China’s “One Belt, One Road” initiative, which promises to spur capital investments and infrastructure development across the region. A cause of worry has been the steady rise of inflation across the region. Although central banks have been proactive in trying to contain inflation, the cost of doing business in the region could be adversely affected.

In the context of this macroeconomic backdrop, the labor market is demonstrating several trends that will affect employers in 2017 and beyond.

Labor Market Insights

Although the aging workforce is not as pronounced a problem in Asia as it is in developed economies, it is certainly an area of growing concern for businesses. The working populations of Japan, Hong Kong, South Korea, Singapore and Thailand all have a median age of well over 40 years. On the other hand, the younger workforces in India, Indonesia and the Philippines present both opportunities and challenges. The World Economic Forum’s 2016 Human Capital Index rates countries globally on two themes: learning and employment. The employment indicators include but are not limited to labor force participation rates, unemployment, underemployment rates and skills. In addition, the Index includes learning — not only the quantity but also the quality of the available learning infrastructure.

Women’s participation in the labor market remains very low in countries like India and Indonesia, and although participation rates may look healthier in other countries, such as the Philippines, deeper systemic issues still need to be addressed. Mercer’s When Women Thrive, Businesses Thrive data show that women currently hold only 25 percent of professional roles in Asia, which is the lowest level in the world and significantly below the global average of 35 percent.[1]

Another trend having an impact on labor markets is the growing talent shortage, particularly among roles requiring engineering and sales skills. In Asia Pacific, 46 percent of companies surveyed by Manpower Group this year cited difficulty in filling positions, as opposed to 40 percent of companies globally. In addition to technical skills, behavioral competencies are becoming increasingly important as a reflection of how employees deal with change.[²] The World Economic Forum’s 2016 The Future of Jobs report cites core work-related skills such as complex problem-solving, active learning and cognitive flexibility as increasingly important to all sectors amid the digital disruption of the Fourth Industrial Revolution — a term famously coined by the founder of World Economic Forum, Karl Schwab.[³]

Tightened Belts, Long Road

Companies across Asia Pacific are currently thinking about how best to reward employees to attract, motivate and retain the talent they need to support their businesses. The link between pay with performance is regarded as one of the top three drivers of employee engagement in Asia, according to the recent Mercer | Sirota research.[4] Employees in Asia care most about a culture of meritocracy and opportunities to grow in their careers. Any conversation around rewards must therefore take into account the specific needs of the talent pool in this part of the world and the motivators that drive these individuals. For this reason, an increasing number of HR departments are beefing up their analytics capability to facilitate evidence-based decision-making, especially when developing a compelling rewards strategy.

Look Who Is Hiring

Hiring in India, Vietnam and the Philippines is happening at a greater pace compared with other countries in the region — for example, hiring intentions are lower in Singapore, Malaysia and Hong Kong. The overall hiring outlook is bright, however, with five out of 10 companies looking to maintain headcount, including replacements for staff turnover.[⁵] Hiring sentiment is often therefore a reflection of trends in staff turnover in certain countries and industries. The flipside of higher GDP growth and increases in base pay also implies that the staff turnover is higher for those countries. Attrition is higher for industries that have continued to outpace the slowdown we observed in the preceding year. Consumer and retail industries are faced with the highest levels of attrition, whereas the manufacturing industry has some of the lowest levels of attrition in the region.[⁶]

As companies prepare themselves for digital disruption, they recognize the need to hire experienced talent — especially in areas that are critical for future success. We find that roles in engineering, finance, sales and marketing functions are particularly difficult to fill in most countries in Asia. Unsurprisingly, the sales function has the hardest time retaining talent.[⁷] Companies have a strong case to develop a sales incentive program that actually works in attracting and retaining key sales talent.

Protecting The ‘Pay Base’

The huge spread in base-pay increases across Asia Pacific is a clear reflection of the dichotomy of emerging versus matured economies, but also of dominant industries in the respective countries exerting heavy influence on the overall picture.

With Asia increasingly becoming a hub for both research and manufacturing in the life sciences industry, we see the highest salary-increase levels in this sector, followed by higher-than-average salary increases in the high-tech and consumer industries.[⁸]

An interesting dynamic that is often overlooked involves pay-increase cycles during the fiscal year. Some companies follow the calendar year, whereas others announce salary increases during April or May. From a talent-retention standpoint, companies need to be aware of the cycles followed by their competitors to be able to ascertain how their pay competitiveness is being perceived by talent both within and outside the organization.

According to the recent Mercer Talent Trends research, 47 percent of employees ranked fair and competitive compensation as the number one factor that would improve their work situation — yet only 28 percent of HR professionals plan to focus on ensuring rewards competitiveness in 2017.[⁹] In addition, transparency around pay decisions was called out as an important factor by employees in Asia Pacific. We find that this divide between HR intent and employee expectations can have negative implications on retention, especially in high-growth countries such as India, in high-growth industries such as life sciences and in high-growth skill areas such as sales.

Pay equity with regard to reducing the gender gap has also received significant attention recently, as workforce analytics provide greater insight into how gender can affect salary decisions. With salary information increasingly being made available online on job boards and social media, employees are becoming more demanding with regards to transparency and disclosures around senior management pay. Rewards professionals need to reduce ambiguity and discretion in pay-related decisions and leverage empirical data analytics to map the business priorities and how those align with the overall rewards philosophy.

With Asia leading the world’s growth, there is no dearth of highly skilled professionals from the western hemisphere seeking opportunities here. As a result, we have seen a significant dip in the traditional expatriate salary packages, with more than 75 percent of the compensation plans designed for foreigners in Asia based on the “local plus” model, which provides certain allowances with the comparable base local pay as the foundation.[10]

Conclusion

Companies that have tended to take a reactionary or cookie-cutter approach to compensation design find themselves struggling to attract and retain talent. Creating differentiation amid increasing cost pressures isn’t easy, but it is more critical than ever before. Creating a rewards proposition that works for all your employee segments requires an analytical approach that takes all these trends into account and ties them to the desired competitive positioning for the business in this hot talent marketplace. Successful companies tend to have a much more dynamic approach, staying flexible and making changes along the way as new trends emerge.

1 Mercer. When Women Thrive, Businesses Thrive, available at https://www.mercer.com/our-thinking/when-women-thrive.html.

2 ManpowerGroup. Employment Outlook Survey, 2017.³ World Economic Forum. The Future of Jobs, 2016.

4 Mercer | Sirota research, 2017.

5 ManpowerGroup, 2017.

6 Mercer, Asia Pacific Pulse Survey, Q3 2017.

7 Mercer | Sirota research, 2017.

8 Mercer | Sirota research, 2017.

9 Mercer. Talent Trends, 2017.

10 Mercer. Global Mobility Snapshot, 2017.