“In a perfect healthcare ecosystem, all groups work hand-in-hand. But in reality, the system is fragmented and complex.”

No two organizations are the same. Each has different employees, strategies and business objectives. The same principle applies to managing your healthcare costs. The solution is unique to you, and companies across Asia are getting creative in exploring alternative approaches to managing benefits spend.

Often, companies have a one-dimensional understanding of their medical schemes gleaned through external benchmarks. But other players in the healthcare ecosystem - employees and providers - are just as crucial as employers in the ecosystem. While the government provides statutory healthcare benefits in many countries, these tend not to be enough to provide adequate coverage, and therefore, the employer ends up bearing the responsibility of providing medical protection to employees and their families. As for providers, these are the doctors, clinics, hospitals, and vendors that are being used directly by employees; thus, it’s just as important to choose the right providers and manage their behaviors and costs effectively. Lastly in the healthcare ecosystem are the employees; the employees are the everyday users of the health plan, and thus managing employees’ wellbeing before they fall ill becomes critical for organizations to manage benefits spend.

In a perfect healthcare ecosystem, all groups work hand-in-hand. But in reality, the system is fragmented and complex. Across Asia, there’s inevitable market imperfections, from rising medical inflation projected at 10 percent for 2018 1 to inconsistently defined healthcare quality, where employees tend to make emotional rather than rational purchases of services, and have a difficult time differentiating from right and wrong, and good and bad. Thus, in this environment, how do you make sure healthcare costs are affordable for you as an employer and for your employees as the consumer?

Make Healthcare Relevant

As an employer, you bear a lot of the medical costs, so you need to choose the right cost containment measures. Start by looking at your data. This includes studying employee demographics, such as age, gender and family mix. Your HR should also have data on employee absence, from how much sick leave they take to how long before they return to work. Wellness data can be gathered from any wellness or lifestyle program you have in place, such as an annual check-up, maternity program or biometric testing. On top of this, you have medical claims data – medical providers used, drugs prescribed and any disabilities within your workforce.

All this data provides you with a comprehensive medical record of your employees, giving you a 360-degree view of their health and risk profiles. When you link all of this data together, it allows you to design targeted programs specific to your employees’ needs. This is the key to your benefits spend management. But how do you get to the point of effectively managing your healthcare spend?

Meet Your Employees’ Needs with 7 Customization Tactics

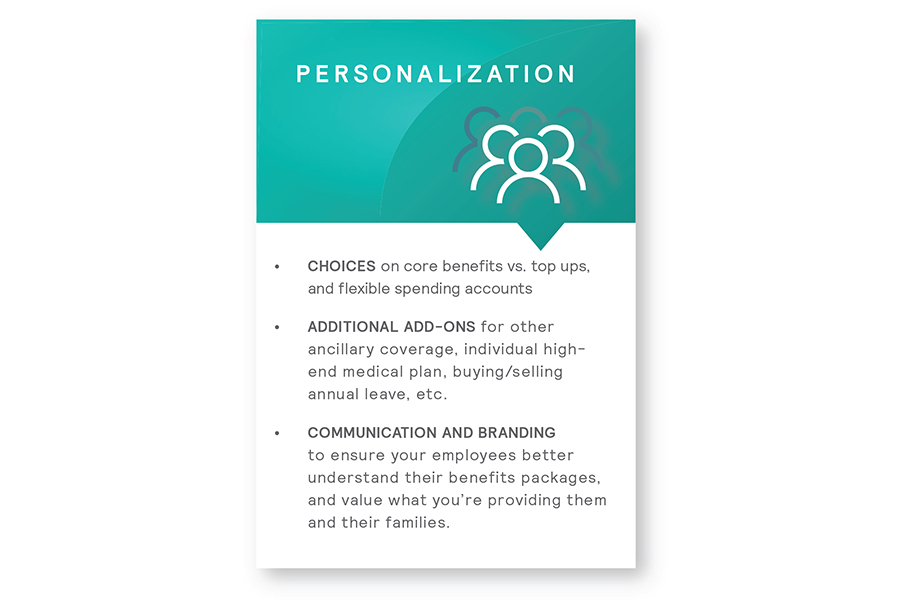

You have probably tried the more traditional approaches such as looking at cutting your plan design, re-marketing your plans or squeezing your insurer to reduce its premiums. However, with medical costs rapidly rising, these tactics are not sustainable in the long run. What can we look at instead? Does it make sense to offer one plan for all employees when their needs and behaviors are different? One size does not fit all, so consider customizing your plan design.

Steering Employees Through Design

Fund Your Medical Plan to Manage Your Risk Exposure

Regarding financing approaches, the traditional approach is to fully insure the plan – that is, pay the insurer upfront premiums. The insurer then pays out all of the claims and takes on the risk. At the other end of the spectrum, is the self-insured model. In this scenario, you as an employer are now responsible for paying all claims. You are not tied to the insurer’s administration or retention costs. By self-insuring, you have the flexibility to decide the terms and plan the design of your medical scheme.

In between these two extremes is the hybrid approach. Here, some employers place high-risk groups under a fully-insured scheme and self-insure the rest of the employees. For example, a high-risk group could be your expatriate employees who prefer more expensive hospitals due to language or culture constraints. Another approach is to place benefits with higher claims volatility, like inpatient coverage, under a fully-insured scheme while self-insuring other coverages – such as outpatient, dental and vision – that are more stable in terms of claims volatility. This method manages your risk exposure and helps control your overall costs.

Another growing trend in Asia is premium co-sharing where companies partially subsidize employees’ medical insurance costs, typically in the range of 20 percent-50 percent. These alternatives are all part of a shift away from the employer taking a paternalistic approach to a facilitator approach. As an employer, you are still providing a safety net for employees, but with a focus on defining minimum standards of care. For this to happen, you need the right vendors who share your vision and can execute on this plan.

Taking Responsibility

Employees are also an integral part of the healthcare ecosystem. Three common risks employers face from their employees include:

1. Utilization: the increasing use of medical schemes leading to higher costs;

2. Healthcare: the risk of poor health and illnesses; and

3. Productivity: the loss of productivity at work due to illness.

All three carry significant financial implications. The solution is in prevention and education. So when you roll out your healthcare programs, the key is to inspire and convince employees that well-being is their responsibility. Not just physical, but emotional and financial wellness too. There are hundreds of vendors, web-based programs, apps and tools today that aim to deliver wellness solutions and incentivize people to change their behaviors for the better. Once again, use the data you have to select a few that resonate with your employees’ needs and can link to cost drivers in your claims experience or health screening.

To successfully care for your employees’ health, while managing your costs, it is important to work with and across the different stakeholders within the healthcare ecosystem. It is only then will you bring about change in the way medical protection and care is provided to your employees.

All three carry significant financial implications. The solution is in prevention and education. So when you roll out your healthcare programs, the key is to inspire and convince employees that well-being is their responsibility. Not just physical, but emotional and financial wellness too. There are hundreds of vendors, web-based programs, apps and tools today that aim to deliver wellness solutions and incentivize people to change their behaviors for the better. Once again, use the data you have to select a few that resonate with your employees’ needs and can link to cost drivers in your claims experience or health screening.

To successfully care for your employees’ health, while managing your costs, it is important to work with and across the different stakeholders within the healthcare ecosystem. It is only then will you bring about change in the way medical protection and care is provided to your employees.

Here are the 8 solutions that are gaining popularity:

1 https://www.mercer.com/our-thinking/health/mercer-marsh-benefits-medical-trends-survey-2018-digital.html