“Employers can use the principles of behavioral economics to understand what influences employee healthcare decisions and encourage healthier choices.”

What is Behavioral Economics?

Behavioral economics theory diverges from traditional economic theory by asserting that individuals don’t always act out of self-interest — that is, we don’t always engage in behaviors that help us maximize benefits and minimize costs. We can be over-reliant on the first piece of information that’s presented to us; we’re often unduly influenced by who relays information to us; and we have a tendency to do what those around us do — inclinations which can prevent us from making good decisions.

How Can Behavioral Economics Be Applied to Health Interventions?

Put simply, our behaviors impact our health. Noncommunicable diseases, which include cardiovascular diseases, certain cancers, chronic respiratory disorders and diabetes, account for 70 percent of deaths worldwide.[1] These diseases are largely the result of lifestyle choices: The World Health Organization attributes nearly all premature deaths to smoking, unhealthy diet, physical inactivity and harmful use of alcohol.[2] These findings strongly suggest that the root cause of preventable premature deaths is poor decision-making. Making better personal decisions can help reverse this negative trend, potentially preventing millions of premature deaths per decade.[3]

How can we encourage people to make better lifestyle choices? According to Sophia Van, Chief Technology Officer at Mercer Marsh Benefits, applying behavioral economics and gamification can help get people “hooked” on healthy behaviors, making a positive impact on health and reducing mortality risks. As just one example, the “quantified self” movement — using wearable technology to monitor the foods we eat and the amount of exercise we get each day — is promoting healthier lifestyles by encouraging people to track, and thus change, their behaviors.

Incentivizing Employees to Make Healthier Choices

South Africa’s largest insurer, Discovery, in partnership with Vitality Group, has pioneered a wellness insurance program that harnesses the power of behavioral economics to engage employees and motivate them to make better health decisions. Discovery was among the first to incorporate lifestyle factors into its life and health insurance underwriting model. The program demonstrates that providing members with incentives helps create sustainable change. Offering rebates of between 10 percent and 25 percent for purchases of fruits, vegetables and other healthy foods nudged members to eat healthier.[4] Rewarding those who completed a “Vitality Age” test — a survey designed to assess overall health — with movie tickets helped increase members’ engagement with their health.[5]

Discovery tracked engagement results over a five-year period, with one of the categories being exercise. Initially, about 50 percent of those in the program were inactive; by the end of the five-year period, that percentage fell to 30 percent. This reduced hospital costs by 6 percent per member for those who started to exercise.[6]

Unlike other business models built solely on wearables, Discovery’s model has proved to be sustainable because it’s based on an innovative customer engagement platform that offers members incentives and rewards.

Applying Behavioral Economics Principles to Benefits Selection

More and more employers are providing flexible benefits options, allowing employees to select benefits products ranging from medical insurance and dental/vision care to lifestyle products (such as gym memberships) to suit their needs. Employers purchase a fixed number of flex credits for every employee, and employees are given the option of purchasing additional credits for premium products.

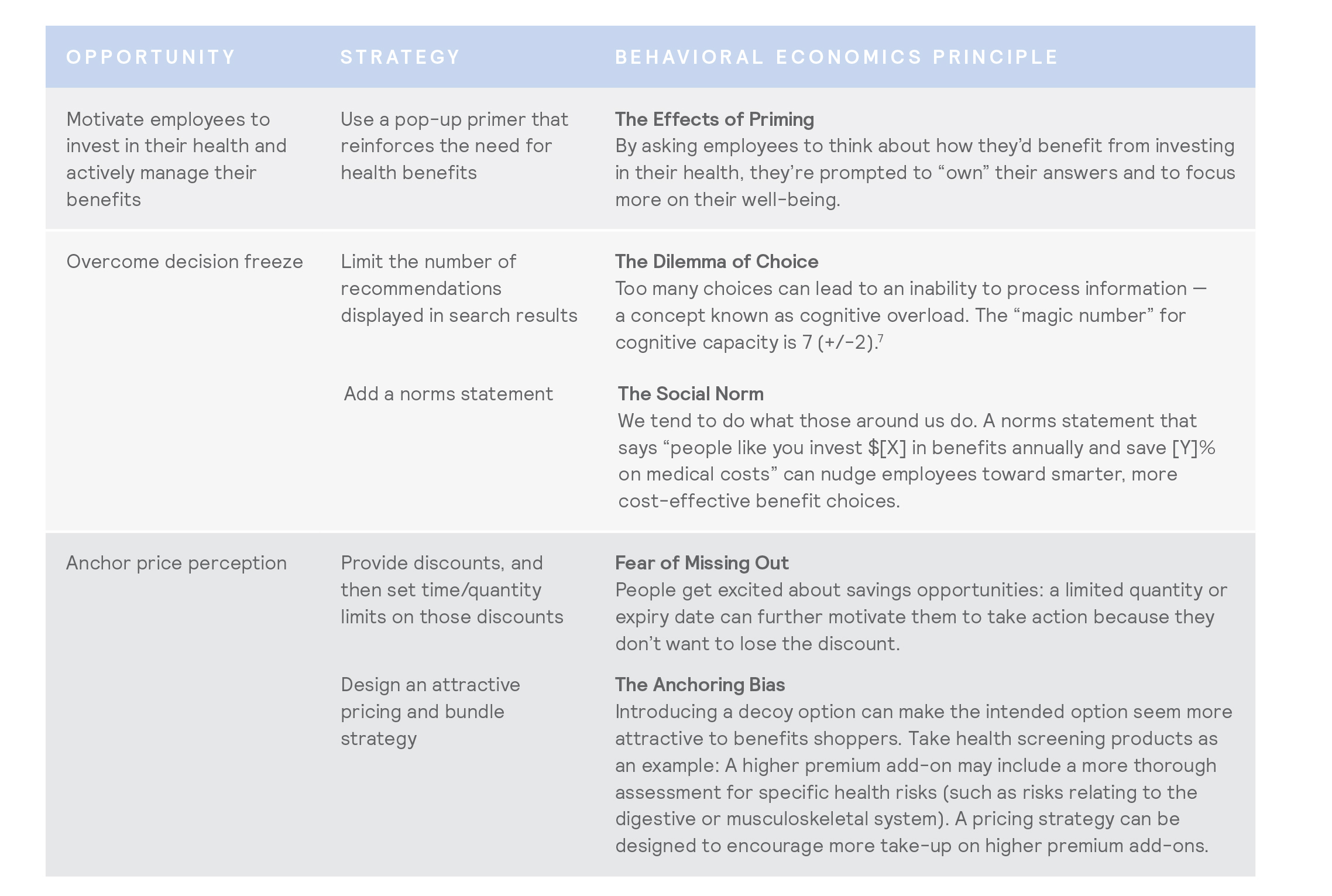

When we apply behavioral economics principles to better understand the behaviors of individuals who shop for flexible benefits online, we find three barriers that prohibit individuals from making better benefits decisions:

1. Low motivation

- Individuals log in to an online benefits mall only once or twice a year to make their benefits selections. They may not fully appreciate the value of their benefits and may not be willing to spend time and effort in making their selections.

- Employer-purchased benefits often go unused. No matter how well designed a flex benefits program is, if the program isn’t being used, it can’t help individuals achieve their desired health goals.

2. Difficulty making decisions

- When presented with too much information, individuals may “freeze” and make no decision at all. If employees can’t readily understand how the benefits products being offered relate to them personally, they may not fully utilize them.

- People seek “social proof,” such as product reviews, for what to buy or what service to use. Without knowing how their peers in a similar life stage choose their benefits, people may revert to the “no decision” default.

3. Perceptions about price

- Individuals often don’t fully understand the true value of products and are attracted by discounts and free goods. If they don’t see discounts or “freebies” associated with the benefits products being offered, they may choose other products or look elsewhere for their benefits needs.

To overcome these challenges, organizations can use strategies anchored by behavioral economics principles to enhance benefits selection for employees:

Promoting a Healthy Workforce

Putting behavioral economics principles into action can help growth markets employers overcome the obstacles that prevent their employees from adopting healthier behaviors. These efforts can shape the way employees interact with their benefits for the better, helping organizations and their people create sustainable behavior change and achieve their health management goals.

1 World Health Organization, “The Top 10 Causes of Death,” January 2017, available at http://www.who.int/mediacentre/factsheets/fs310/en/

2 World Health Organization, Global Action Plan for the Prevention and Control of Noncommunicable Diseases 2013–2020, available at http://apps.who.int/iris/ bitstream/10665/94384/1/9789241506236_eng.pdf

3 Ralph L. Kenney, “Personal Decisions Are the Leading Cause of Death,” Operations Research 56.5, November–December 2008, available at https://orsagouge. pbworks.com/f/keeney.pdf

4 “How Discovery Keeps Innovating,” available at http://healthcare.mckinsey.com/how-discovery-keeps-innovating

5 Discovery Vitality, 2014 Vitality Journal: Improving Health and Reducing the Cost of Health Care Through Lifestyle Interventions.

6 The Digital Insurer, “In View: Discovery Health Vitality Wellness Program,” available at https://www.the-digital-insurer.com/dia/discovery-health-vitality- wellness-program/

7 Piyanka Jain, “Five Behavioral Economics Principles Marketers Can’t Afford to Ignore,” Forbes, March 1, 2013.