“With rising equity prices and falling bond yields, the 60:40 portfolio has proven difficult to beat since the global financial crisis.”

It’s a fact of life that nothing works well all the time. That’s where multi-asset strategies have a valuable role to play in investors’ portfolios. Yet deciding when, for whom and how multi-asset strategies should be implemented is a complex calculus. Here we detail the four main types of multi-asset strategies and their benefits compared to traditional static allocation approaches, as well crucial considerations for those implementing multi-asset strategies.

The strength of multi-asset strategies lies in adopting varying approaches to asset allocation, with contrasting views and contrasting bets on the future. To implement multi-asset strategies, however, investors should understand not only the reasons they can be beneficial, especially in the current market environment, but also the different styles of multi-asset strategies that exist and how to successfully implement them.

The Case for Multi-Asset Strategies

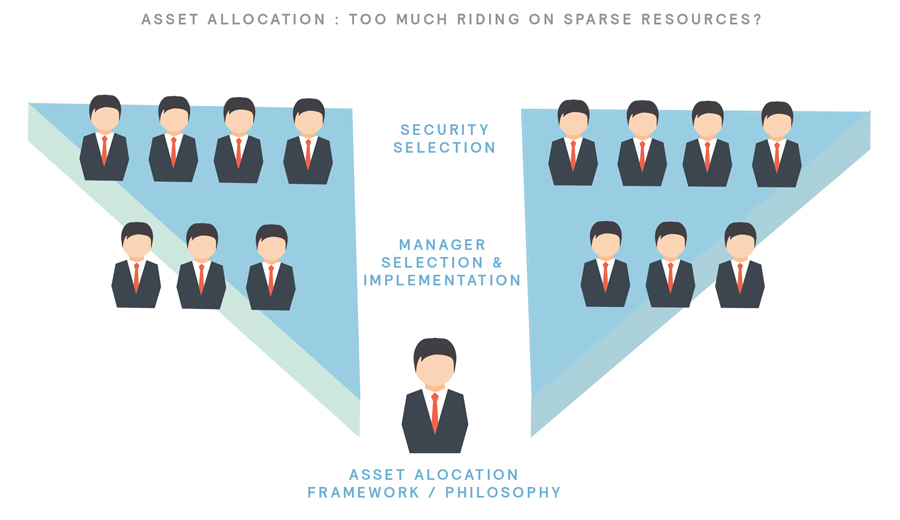

Asset allocation is typically the most significant driver of a portfolio’s return, but is typically determined by a single individual or committee and a single framework. By contrast, large teams are deployed to focus on manager selection and security selection—despite the fact that this generates less value, net of fees.

This disparity in resources and concentration of decision making power arguably represents a vulnerability to most investors’ portfolios. Many multi-asset strategies, on the other hand, seamlessly blend a wide variety of approaches and parameters into a single strategy.

Types of Multi-Asset Strategies

A highly diverse population of multi-asset strategies has emerged, but the strategies can be grouped into four basic categories.

- 1. Core: These strategies are predominantly driven by traditional beta, with relatively limited tactical asset allocation.

- 2. Idiosyncratic: More focused on absolute returns, idiosyncratic strategies provide access to a broader range of return drivers and are more dynamic in their asset allocation, resulting in greater downside mitigation than core strategies.

- 3. Risk parity: These encompass a broad range of approaches to building a risk-balanced portfolio, often by leveraging lower-volatility assets.

- 4. Diversified inflation: These attempt to build an inflation sensitive portfolio, typically with an absolute return target. Example holdings include treasury inflation protected securities (TIPs), natural-resource equities and commodities.

Many investors have been disappointed with the performance of multi-asset strategies in recent years. This perceived underperformance is in part due because investors compare these strategies to a traditional 60% equity: 40% fixed income portfolio. With rising equity prices and falling bond yields, the 60:40 portfolio has proven difficult to beat since the global financial crisis. Multi-asset strategies have also lagged due to more diversified sources of return. So why bother with multi-asset strategies? Here are four reasons:

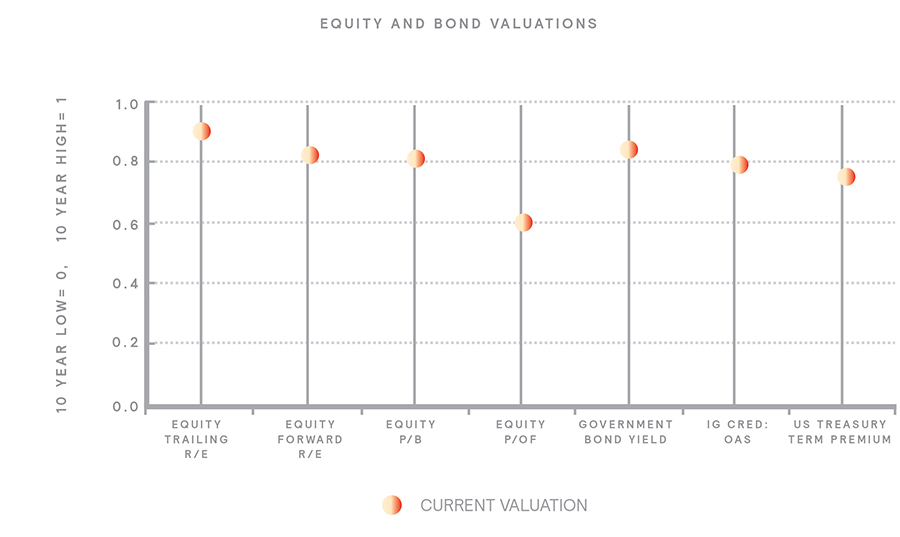

1. Mean reversion: It’s unlikely that the 60:40 portfolio will continue to be upheld as a standard of measurement. Bonds and equities can no longer be considered cheap, which makes it challenging to repeat recent successes.

2. Rising correlation between bond and equity returns: This reduces the diversification within a traditional 60:40 portfolio and indicates that portfolios with a broader range of return drivers and less reliance on beta will be the norm going forward.

3. Reflation: Even modest inflation could challenge traditional portfolios given low bond yields and current equity valuations.

4. Forward-looking risks: From politics and rising protectionism to the unknown impact of central banks shrinking their balance sheets, a number of factors suggest the future may look quite different than the past.

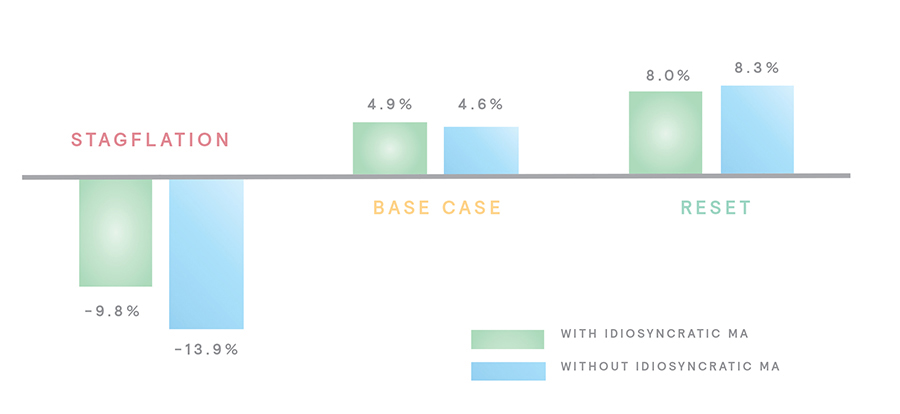

To highlight the potential benefits of holding a more diversified portfolio in the hypothetical example shown here, we compare how a 60:40 portfolio may perform relative to a portfolio that takes 10 percent away from both equities and bonds and allocates it into an idiosyncratic multi-asset strategy, chosen because of the diversification benefits and opportunity set such a strategy may present to today’s investors.

In a downside scenario—one where a 200-basis-point upward shift in the yield curve is complemented by a 15% fall in equity prices—the 60:40 portfolio returns -13.9 percent, whereas the portfolio which has a small allocation to an idiosyncratic multi-asset strategy returns -9.8 percent, even assuming the multi-asset manager underperforms its investment objective.

In a base case, where bonds return their current yield and equities deliver in line with Mercer’s capital market assumptions, the performance is virtually identical, and including a multi-asset strategy may improve the outcome by about 30 basis points.

In an upside scenario, where equities return 15% and the yield curve moves up by only 50 basis points, we see an 8.3% return for the 60:40 portfolio, while the portfolio including the multi-asset component only underperforms by around 30 basis points.

The argument for including a multi-asset strategy within a broader diversified portfolio is compelling.

Doing so offers more robustness in significant downside scenarios, slight outperformance in all market conditions, and only slight underperformance in strong market conditions.

Landing Multi-Asset Strategies

Several issues deserve consideration when thinking about using multi-asset strategies.

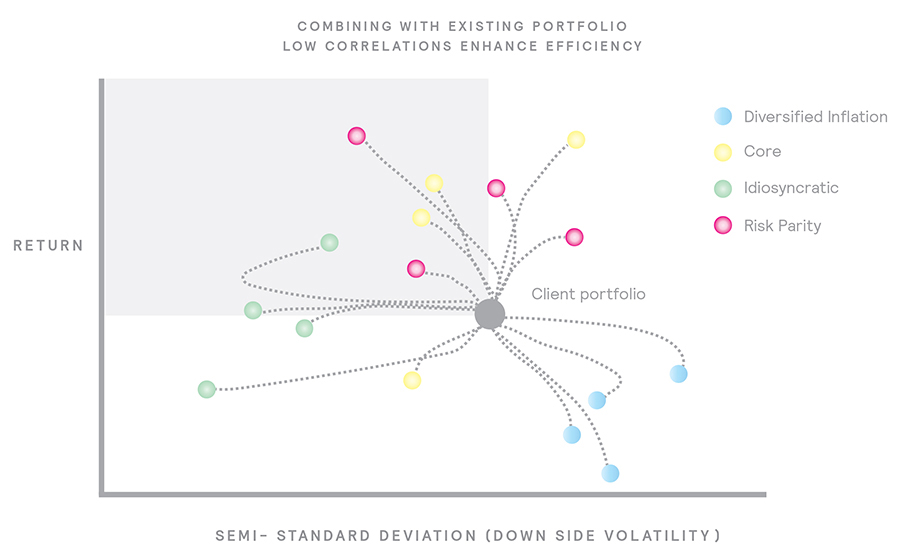

First, it’s important to take a forward-looking approach when thinking of combining these strategies, based on a good understanding of investment approaches used and the typical biases within those strategies. Typically we look for correlations below zero when blending managers, but in the multi-asset space, aiming for the 0.4 to 0.6 correlation band is a realistic figure that will still provide meaningful diversification benefits over time.

The second factor to consider is client characteristics, which a couple of examples will help illuminate. Mercer typically recommends allocating to a diversified hedge fund exposure, but this may not always be realistic for all clients. This is where multi-asset strategies can come into play.

For a client with an established strategic asset allocation dominated by traditional beta, idiosyncratic strategies bring the biggest bang for the buck in terms of diversification and downside mitigation. However, some core and risk-parity strategies also confer benefits, given their unique risk/return profile. Again, the choice comes down to taking a forward-looking approach and determining whether these strategies continue to perform given the market backdrop.

By contrast, consider a client who has a static asset allocation with fixed income, mostly government-bond and investment-grade credit, plus some equities, and cannot go beyond these asset classes because of governance, resources and even lack of expertise. In this case, multi-asset strategies bring in additional diversifying exposures and introduce some dynamism into the tactical allocation, without the complexities of introducing a tactical asset allocation overlay.

A third important factor is the risk of manager diversion. Investors often compare multi-asset strategies to traditional 60:40 benchmarks—an inappropriate comparison that nonetheless may lead managers to abandon their discipline and focus on outperforming the 60:40 rather than their own strategy benchmark.

As a hypothetical example, consider two multi-asset managers, both with cash-plus benchmarks.

Manager A retains their discipline, but Manager B, possibly under pressure from clients, manages the strategy by not straying too far from the 60:40 portfolio. If equity markets were to crash, Manager B would significantly underperform Manager A. Following that, Manager A, despite being aware of Manager B’s poor performance, may be afraid to cut their equity allocation for fear of underperforming the other managers on the equity-market rebound.

Looking at calendar year returns in 2008, the median idiosyncratic strategy returned -9.6 percent, compared to -24.6 percent for the 60:40 portfolio. So in a market environment like the global financial crisis, losing discipline can cost you around 15% in returns.

Finally, in order to truly make the most of multi-asset strategies, clients need to gain comfort with relatively unconstrained investment guidelines, in particular the use of leverage and derivatives. This is particularly true for strategies that have a low equity beta, as there is a need to lay off the non-idiosyncratic risks to take advantage of idiosyncratic opportunities or lowly correlated investment ideas. Having a wide variety of instruments broadens the opportunity set and gives the manager discretion to implement in the most efficient manner.

By contrast, the opportunity cost of not gaining comfort with leverage and derivatives is substantial. Without exposure to those lowly correlated assets, a portfolio would be at risk in the event of an equity or bond market crash. Multi-asset strategies can play an important role in diversifying investors’ asset allocation frameworks and philosophies, while also broadening the set of return drivers and diversifiers to improve portfolio robustness.